We all use credit cards, don’t we? What Is a Cash Back Credit Card? How does CIBC’s cashback credit cards compare with others in the market? Every day we use credit cards to pay for shopping expenses, grocery purchases, pay bills and so on. While we make purchases using the credit card, we will earn valuable reward points or certain cashback percentage on the transaction, depending on the credit card type we have.

CIBC offers four cashback credit cards – CIBC Dividend Visa Infinite Card, CIBC dividend Platinum Visa Card, CIBC dividend Visa card, CIBC dividend Visa card for students. The annual fee for the first two cards is $99 per year (note – first-year annual fees is waived).

The dividend Visa and Dividend Visa for students cash back cards are priced at a The dividend Visa and Dividend Visa for students cash back cards are priced at a The Dividend Visa and Dividend Visa for students cash back cards are priced at a $0 annual fee.

With that said, the benefits and features are more inclined towards the first two premium cards. In this article, let us look at the best cashback CIBC Credit Cards and how they stack up with each other in terms of earning good cashback rewards for you on the regular purchases and everything else.

In Canada, you have the option of choosing the credit card which will suit your needs and preference.

For example, you can get the CIBC’S Infinite or dividend range cash back credit cards. But, every credit card comes with an annual fee associated with it, again the cashback you’ll earn will depend on the card you have and where you are making the purchases (will talk about it a bit).

Now, Let’s get started.

CIBC Cash Back Credit Cards

CIBC is one of the premier banks In Canada, often considered as one of the big 5 banks with a wide presence across the country.

Regarding the cashback credit cards, CIBC has a variety of credit cards in its portfolio.

When it comes to CIBC’s cashback credit card – they do have four cashback credit cards.

1. CIBC dividend Visa Infinite Card

2. CIBC Dividend Platinum Visa Card

3. CIBC Dividend Visa card

4. CIBC Dividend Visa card for students

Now, let us compare all the four Cash Back Credit Cards offered by CIBC.

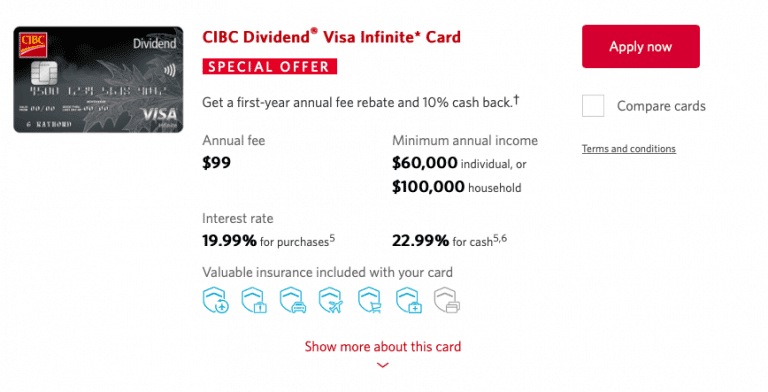

1. CIBC Dividend Visa Infinite Credit Card

The CIBC Dividend Visa Infinite Credit Card is the top of the range card offered by CIBC. It is for the premium crowd and let’s look at the benefits and features it offers.

Annual Fee – $99 (First-year annual fee is waived)

Interest Rate – 19.99% for regular purchases

22.99% for cash transactions (This is pretty standard in the industry unless you opt for the low-interest credit card range)

Minimum Annual income Required To Apply for The Credit Card – $60,000 Annual – Canadian Dollars for Individuals or $100,000 as a Household Income

Benefits & Features Of The CIBC Dividend Visa Infinite Card

1. You’ll get the first-year annual fee rebate and 10% cashback on total purchases of up to $2,000 max (Promo only for new customers).

2. Rewards Program – Cash Back (Type of credit card)

3. Once the promo sign-up of 10% cashback expires, you will get 4% cashback for gas and grocery purchases, 2% on Tim Horton’s and Telus store purchases and 1% on every other purchase.

4. There’s no limit on the cashback you will earn in a calendar year

5. You will also be eligible to get 15 days of out-of-province medical coverage which is pretty useful.

6. Apart from the above-said benefits, you will also be covered for any flight delays and baggage insurance (to get this benefit, you should use the CIBC dividend Visa infinite credit card at the time of booking the flight ticket)

7. Trip Interruption Insurance is also covered

8. Auto Rental Collision and Loss Damage Insurance

9. Common Carrier Accident Insurance of $500,000

10. Purchase Security and Extended Protection Insurance

2. CIBC Dividend Platinum Visa Credit Card

One thing to note when it comes to CIBC credit cards is, the infinite series is the more premium brand and has better benefits when compared to the platinum cashback credit card.

With that said, it’s also important to note here that, the Platinum credit card range also offers fantastic value for money.

Annual Fee – $99 (First Year annual fee is waived)

Interest Rate – 19.99% for regular purchases

22.99% for cash transactions

Minimum Annual Income Required To Apply for The Credit Card – $15,000 as Household Income

As you can see, both the CIBC Dividend Visa Infinite Card and the CIBC Dividend Platinum Visa Card cards have the same annual fee of $99, interest rates are the same, but the only difference is with the Minimum Annual Income required to apply for this card.

If you are a new immigrant or don’t have the income yet to apply for the infinite series, you can definitely apply for the CIBC Dividend Platinum Visa Card. As I said, it’s loaded with fantastic benefits and features. Now then, looks at what the benefits and features of this card are.

Benefits & Features Of The CIBC Dividend Platinum Visa Card

1. You’ll get the first-year annual fee rebate and 10% cashback on total purchases of up to $2,000 max.

2. Rewards Program – Cash Back

3. Once the sign-up 10% cashback promo expires, you will get 4% cash back for gas and grocery purchases, 2% on Tim Horton’s and Telus store purchases and 1% on every other purchase.

4. There’s no limit on the cashback you will earn in a calendar year

5. Auto Rental Collision and Loss Damage Insurance

6. Common Carrier Accident Insurance of $500,000

7. Purchase Security and Extended Protection Insurance

8. You’ll also get the Optional CIBC Emergency Travel Medical Insurance

9. Extra protection on new purchases – With this feature, you can double the manufacturer’s original warranty up to one year on most of your purchases

As you can see, there’s not much you lose opting for the CIBC dividend Platinum Visa card, however, anyone who meets the minimum eligibility criteria should go for the infinite series as it offers better features and more value for money. Mind you, the annual fee is the same for both the cards at $99 per year.

3. CIBC Dividend Visa Credit Card

Now let us look at the third cashback credit card from CIBC which is the CIBC dividend Visa Credit Card.

The best and the most important feature of this cashback credit card is – NO ANNUAL FEE or $0 Annual Fee.

Yeah, that’s right. There’s no annual fee on this credit card. However, there are a couple of compromises as well. Nevertheless, let’s take a look at the card’s benefits and features.

Annual Fee – $0

Interest Rate – 19.99% for regular purchases

22.99% for cash transactions

Minimum Annual Income Required To Apply for The Credit Card – $15,000 Household Income

As you can see, the annual fee is $0, Interest rates remain the same as the previous two CIBC cash back credit cards as discussed. The minimum household income required is also the same as the CIBC dividend Platinum Visa Card.

Benefits & Features Of The CIBC Dividend Visa Card

1. NO ANNUAL FEE or $0

2. Rewards Program – Cash Back

3. Once the sign-up 5% cashback promo expires, you will get 2% cashback for gas and grocery purchases, 0.5% on Tim Horton’s and Telus store purchases up to $6000 purchase limit and 1% on every other purchase above $6000.

4. There’s no limit on the cashback you can earn in a calendar year

5. Common Carrier Accident Insurance of $100,000

6. Purchase Security and Extended Protection Insurance

7. You’ll also get the Optional CIBC Emergency Travel Medical Insurance

8. Extra protection on new purchases – With this feature, you can double the manufacturer’s original warranty up to one year on most of your purchases

4. CIBC Dividend Visa Credit Card For Students

Now let’s look at the fourth and the final cashback credit card from CIBC which is the CIBC dividend Visa Credit Card for students. This credit card is exclusively for students who want to build their credit history before getting employed or just out of college.

The best and the most important feature of this credit card is – NO ANNUAL FEE or $0 Annual Fee.

Yeah, you heard it right. There’s no annual fee on this credit card like the previous one. However, there are a couple of compromises as well. Never mind, let’s take a look at the card’s benefits and features.

Annual Fee – $0

Interest Rate – 19.99% for regular purchases

22.99% for cash transactions

Minimum Annual Income Required To Apply for The Credit Card – $0

The annual fee for the CIBC dividend Visa card for Students is The annual fee for the CIBC Dividend Visa card for Students is $0 or no-fee or no-fee, Interest rates remain the same as the previous two CIBC credit cards as discussed. The minimum household income required is the same as the CIBC dividend Platinum Visa Card.

Benefits & Features Of The CIBC Dividend Visa Card for Students

1. NO ANNUAL FEE

2. Rewards Program Cash Back

3. Once the sign-up 5% cashback promo expires, you will get 2% cashback for gas and grocery purchases, 0.5% on Tim Horton’s and Telus store purchases up to $6000 purchase limit and 1% on every other purchase above $6000

4. There’s no limit on the cash you can earn in a calendar year

5. Common Carrier Accident Insurance of $100,000

6. Purchase Security and Extended Protection Insurance

7. You’ll also get the Optional CIBC Emergency Travel Medical Insurance

8. Extra protection on new purchases – With this feature, you can double the manufacturer’s original warranty up to one year on most of your purchases

CIBC dividend Visa card and CIBC Dividend Visa Card for Students is both almost similar in terms of benefits and features, except that the latter is more for students with a $0 annual income requirement. Apart from this, everything else is the same when compared to the CIBC dividend Visa credit card.

CIBC Cash Back Credit Cards – Comparison

There you go, we just had a look at all of the 4 cashback credit cards offered by CIBC.

In a nutshell, CIBC Dividend Visa Infinite Credit Card and the CIBC Dividend Platinum Visa Card are the top #1 and #2 offerings from CIBC for the cashback credit card portfolio.

The only difference between all of the four cashback credit cards is in terms of the minimum annual income requirement. Every other benefit and cashback earning potential is almost 99% the same including the annual fee of $99.

When it comes to tier #3 and tier #4 cashback credit cards from CIBC which are – CIBC Dividend Visa card and CIBC Dividend Visa card for students – They both have $0 ANNUAL FEE and lesser minimum annual income requirement compared to the first two.

CIBC Cash Back Credit Card Redemption

I have been banking with CIBC for almost 4 years now.

I do have the CIBC dividend Visa Infinite Credit Card at the moment, on every monthly e-statement I see the cashback dollars I’ve earned for the previous month. It accumulates month after month.

Usually, in December statement, CIBC will automatically apply the cashback that I’ve earned over the past 11 months towards my outstanding balance. I have called the customer care, just to find out if I can redeem my cashback towards the bill payments earlier than December, but unfortunately, they do not allow this yet. So, all you have to do is, wait till December to get the cashback redeemed.

If you have the cashback credit card and make a switch to the points cards for example, then probably your cashback will be applied towards your outstanding bills payments.

Conclusion

CIBC is one of the premier banks In Canada with more than 3800+ branches coast-to-coast. It’s also one of the big 5 banks in Canada.

The cashback credit cards from CIBC are one of the best in the industry and should be considered for your day-to-day purchases and bill payments.

Usually, in December, you get back all of your cashback In the form of paying off your credit card outstanding balance.

Depending on your income level, both individual and household income, you can opt for the infinite or platinum cashback credit card, as both have the same annual fee of $99.

If you want to consider the $0 cash back credit card from CIBC, you will earn less cashback percentage but you don’t have to pay an annual fee. If this is something you are looking for you have the option of choosing the CIBC Dividend Visa card and for students, it is the CIBC Dividend Visa card.

Please share this article on social media and help spread the word. Let me know your thoughts and comments below.