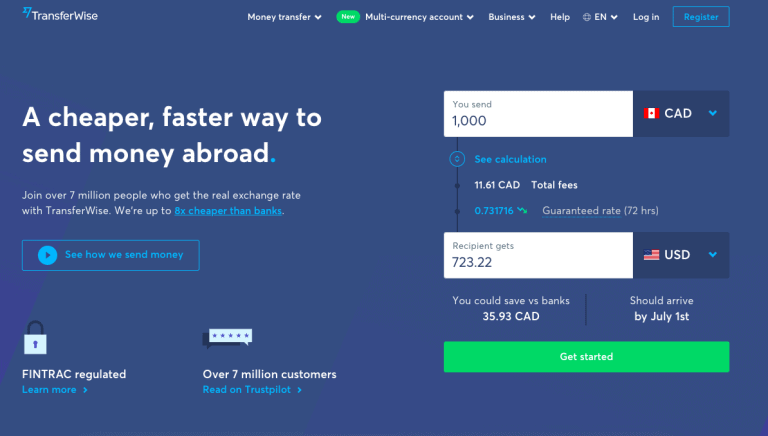

TransferWise is an international money transfer service company. It has a remarkable system of executing cross-border transactions at a significantly faster pace and cheaper price. In fact, their transfer rates are up to 8 times cheaper than the average bank rates.

Simply put, TransferWise is a faster and cheaper way to send money abroad compared to conventional means like using PayPal and wire transfers. In this review let’s look at how the service works, pros and cons, fees, examples, and how it compares to competitors like PayPal (Xoom), Western Union, Remitly, Money Gram, etc. Now, then let’s get started.

What Is TransferWise?

TransferWise is an innovative international money transfer provider. They prioritize by making money transfers more affordable than the traditional banks by charging low and transparent transfer fees and converting funds at the true mid-market exchange rate.

This means your money is exchanged at the rate most banks and other financial services companies employ when trading among themselves. It’s the fairest and easiest way to manage your money across borders.

TransferWise was co-founded by Taavet Hinrikus and Kristo Käärmann, and launched globally in 2011 and in Canada in 2016. It is one of Europe’s most successful fintech startups having raised $117M in funding from investors such as Andreessen Horowitz, Sir Richard Branson, Valar Ventures, and Max Levchin of PayPal.

Currently, the company is available in 59 countries having more than 7 million users around the world. These users transfer about 5 billion dollars every month saving 1.5 billion dollars in exchange fees every year. The company has always tried to be transparent with its fees and exchange rates.

How TransferWise Works

TransferWise, through a borderless account, helps you to send money, receive money, and spend money internationally.

Currently, the platform supports sending money to 71 countries and from 43 countries. They cover 1000+ routes across 57 currencies.

Sending money across borders ordinarily involves a lot of complicated processes because banks markup the spot exchange rate or mid-market range and therefore add hidden surcharges causing an increase in overall total charges.

With TransferWise you will be shown a breakdown of how much in fees sending money will cost you, they exchange the currencies at the mid-market rate which you can easily confirm on search engines online.

TransferWise can afford to make things cheaper because of its innovative approach to keeping currencies local so they do not have to cross the border.

For Example:

If you want to spend $500 CAD to an account in the United States, ordinarily Canadian’s cannot fund the account with US dollars.

So instead, of the money being transferred across the Canadian/U.S. border, TransferWise will add CAD currency to their account in Canada and pay your intended recipient in the U.S. from their account located in the United States.

Getting Started With TransferWise

To get started with TransferWise, All you simply have to do is:

-

Create an online TransferWise account, it takes about a minute to do so and it’s completely free

-

Enter all your essential information and the details of the person who is receiving the money and their bank details. The recipient does not necessarily need to have a TransferWise account

-

Verify your identity and address by uploading the required documentation such as a photo ID or utility bill. The verification process may take up to 2 days so you should be ready to complete this step before you plan to make any transfer

-

Fund your transfer using different methods like; direct debit, wire transfer, debit card, credit card, online bill transfer, SWIFT, SOFORT (Europe), etc

TransferWise Fees and Services

First of all, TransferWise will charge a fee to convert money between currencies in your account.

It varies from currency to currency.

The way TransferWise fees are charged has recently been changed. The easiest way to understand the conversion fees is to take a look at their price checker.

The fees you pay when you transfer money on TransferWise depends on the following:

-

The amount you plan to send: Most currencies supported by TransferWise offer the option of transferring from one bank account to another. A percentage usually less than 1% is charged on the amount and it varies from currency to currency

-

How you intend to pay for your transfer: For some currencies, you can pay with debit or credit cards or use a SOFORT transfer option. Apple Pay and Android Pay can also be used via TransferWise iOS and Android apps. The cost of using the direct debit is lesser than when you pay with a credit card. Also, the use of a credit card will limit the maximum amount you can send per transaction. In most cases, the recipient will get the money within a day or two business days.

-

Exchange rate: The TransferWise exchange rate you’ll receive is the mid-market rate and it has no markup or hidden payments (same as the rates on Google). Depending on the currency, the rate may also be assured for up to 48 hours

List Of Currencies You Can Send And Receive Through TransferWise

-

AUD – Australian Dollar

-

BGN – Bulgarian Lev

-

BRL – Brazilian Real

-

CAD – Canadian Dollar

-

CHF – Swiss Franc

-

CZK – Czech Koruna

-

DKK – Danish Krone

-

EUR – Euro

-

GBP – Pounds Sterling

-

HKD – Hong Kong Dollar

-

USD – US Dollar

-

JPY – Japanese Yen

-

HUF – Hungarian Forint

-

HRK – Croatian Kuna

-

NOK – Norwegian Krone

-

NZD – New Zealand Dollar

-

PLN – Polish Złoty

-

RON – Romanian Leu

-

TRY – Turkish Lira

-

SEK – Swedish Krona

List Of Currencies That TransferWise Can Send To Your Local Bank Accounts

-

AED – Emirati Dirham

-

ARS – Argentine Peso

-

INR – Indian Rupee

-

KES – Kenyan Shillings

-

BDT – Bangladeshi Taka

-

KRW – South Korean Won

-

CLP – Chilean Peso

-

CNY – Chinese Yuan

-

COP – Colombian Peso

-

EGP – Egyptian Pound

-

GEL – Georgian Lari

-

IDR – Indonesian Rupiah

-

ILS – Israeli Shekels

-

LKR – Sri Lankan Rupee

-

MAD – Moroccan Dirham

-

MXN – Mexican Peso

-

MYR – Malaysian Ringgit

-

NGN – Nigerian Naira

-

PEN – Peruvian Sol

-

PHP – Philippine Peso

TransferWise Borderless Account and Mastercard Debit Card

Having a TransferWise Borderless account is like having a local bank account in a country, without ever having to set foot there.

TransferWise makes it easy to receive and send payments in different currencies at their real exchange rate without having to pay extra fees or a minimum balance.

With the borderless account, Canadian businesses and freelancers can do business internationally by:

-

Opening an account to pay and get paid as if they were a local business in that country

-

Receive personal local account numbers for the US, UK, European IBAN, New Zealand, and Australian account number and BSB code in seconds – Canada and others to come

-

Hold and manage balances in 27 currencies and save money on unnecessary conversions and exchange rates

-

Save big on maintenance fees: There are no opening fees or monthly charges and it costs nothing to receive payments

-

Avoid exchange rate markups when moving money across currencies. There’s only a small upfront fee and all transfers are made at the real mid-market exchange rate (i.e. the one you see on Google)

TransferWise Debit Card

As a TransferWise borderless account customer, you’ll have the option to apply for a prepaid debit card.

One important thing to note here is that the debit card has to be applied separately and it’ll only take a couple of minutes to do so.

Once you have applied for, the TransferWise debit card can then be linked to your borderless account for easy money transactions.

TransferWise debit card is backed by Mastercard, so rest assured it’s as good as any debit card in the market that you’ll get your hands on.

As such, the TransferWise Debit card allows you to:

-

Withdraw cash from millions of ATMs globally

-

Purchase goods and services online in your chosen currency

-

Pay for things in-person by entering your 4-digit PIN

It doesn’t cost anything to order your debit card from TransferWise and link it to your borderless account.

Regardless, you will likely be asked to add a minimum balance before the card is allotted to you. This stands at 20 USD/EUR/GBP or 30 NZD. The funds are added to your card nonetheless, so it’s not a fee per-say.

TransferWise borderless account makes sense because

-

Instead of opening a US Dollar bank account in Canada and individual accounts for other currencies

-

This account gives you access to multiple foreign accounts that work just like local bank accounts even though you reside in Canada

When you match the borderless account with a TransferWise borderless debit Mastercard, the cost savings can be huge.

TransferWise Pros

-

It is effective and cheap. With TransferWise, all your transfers can be made abroad without leaving the comfort of your home.

-

TransferWise has remarkable customer service. Their customer service includes an online chat option, email, and telephone support. (available only at a certain time though).

-

They have transparent upfront fees so there are no surprises and a fair and super competitive mid-market rate for best exchange rates.

-

Access to the Multi currency account and Mastercard debit card is granted.

-

A sufficiently functioning mobile app.

-

Provide services to individuals, businesses, and freelancers.

-

A free borderless account that can hold balances in over 40 different currencies.

TransferWise Cons

-

Accounts can’t be funded with cash or cheque. You can only pay by bank transfer, debit card, or credit card.

-

The cash pickup option is unavailable. Recipients can’t get their money, have it delivered, or have it transferred to a mobile wallet.

-

TransferWise currently doesn’t support all currencies or provide transfers into all countries.

-

There’s a certain limit on the amount that can be transferred

-

Delayed account verification and transfers

-

Larger transfers are downrightly expensive to make

-

There are no Interests. By keeping your money in one of your borderless accounts, you will not earn a dime of interest. This is a major short-fall, especially when you consider both opportunity costs and inflation. As such, you might want to consider restricting your deposits to cover only what you need to use.

How Does TransferWise Compare To Other Similar Services

Overall, on the whole, TransferWise provides speedy transfers and to top it all off, they are cheap and easy to utilize.

For example, assuming I want to send $1,000 to a friend in Australia

Note: The currency of the recipient here is AUD.

The following fees will apply using a direct debit (cheapest option for CAD transfers):

Total fees = $10.76 CAD (1%)

Note that the exchange rate (1.06782) is guaranteed for 96 hours and is the same best rate that can be found on Google or xe.com.

If I decide to pay for my transfer using other options, the following fees will apply on the TransferWise transaction (for the same $1,000 CAD amount):

-

Direct debit – $258 CAD fee

-

Debit card – $17.68 CAD fee

-

Credit card – $22.48 CAD fee

-

Domestic wire transfer – $5.50 CAD fee

-

Bill Payment – $5.50 CAD fee

These fees are just an extension of TransferWise’s basic fee of $6.22 CAD For CAD transfers.

TransferWise Direct Debit

Always remember with TransferWise direct debit is your biggest bet for the most savings!

Now compared to other money transfer services and based on the same amount of money. I’ll be paying;

Royal Bank of Canada (RBC): $63.08 at an exchange rate of 1.0384 which is approximately 13 times as much. That’s almost 3% worse than the mid-market rate.

PayPal: Approximately $40 at an exchange rate of 1.0303. This amount is nearly 4% awful than the mid-market rate and entails PayPal’s currency conversion fee. Therefore the additional $4.99 CAD transfer.

PayPal typically adds three fees to a cross-border transfer into another currency. You pay an increase of 2.5% on the base exchange rate to convert it into another currency within your account.

Noticeably, TransferWise is the cheapest option available because they use the more authentic, fair, and favourable exchange rate that does not include any hidden fees.

TransferWise Regulations

TransferWise is a legitimate company that is regulated by numerous relevant authorities in the many countries they operate in. For example:

Canada: They are regulated by Authority des Marches Financiers (AMF) as a money service business. It is also registered with the Financial Transactions and Reports

Analysis Centre of Canada (FINTRAC) as Money Service Business (MSB) registered under the number M15193392.

United States: Registered with the Financial Crimes Enforcement Network (FinCEN). Their funds are kept in banks that are protected under the Federal Deposit Insurance Corporation (FDIC).

United Kingdom: Accepted as an Electronic Money Institution by the UK

Financial Conduct Authority Australia: They are overseen by the Australian Securities and Investments Commission with AUSTRAC.

India: In India, TransferWise is Approved by the Revenue Bank of India.

Japan: Regulated by the Kanto Local Financial Bureau and authorized as a Funds Transfer Provider.

TransferWise vs. Remitly

Let’s say I want to send $1000 from Canada to India (Direct Bank Deposit), how does TransferWise compare with Remitly’s fees:

Remitly:

Express: 54240 INR at an exchange rate of 54.24 (Immediate transfer)

Economy: 54580 INR at an exchange rate of 54.58 (Takes 2-3 business days to hit the recipient bank account)

TransferWise:

$12.30 In Fees

55.0416 is the Guaranteed Exchange Rate

The recipient gets 54,364.59 INR into their bank accounts (direct deposit)

Google exchange rate right now while doing this transaction – 1 CAD = 55.03 INR

Now, take another example for a larger amount and compare the two services:

Let’s say I want to send $20000 from Canada to India (Direct Bank Deposit) in one shot, how does TransferWise compare with Remitly’s fees:

Remitly:

Express: 10,84,800 INR at an exchange rate of 54.24 (Immediate transfer)

Economy: 10,91,600 INR at an exchange rate of 54.58 (Takes 2-3 business days to hit the recipient bank account)

TransferWise:

$179.07 In Fees

55.0416 is the Guaranteed Exchange Rate

The recipient gets 10,90,975 INR into their bank accounts (direct deposit)

Google exchange rate right now while doing this transaction – 1 CAD = 55.03 INR

Quick Observations:

-

Even though TransferWise is open about showing you the fees per transaction, the amount received is almost the same as compared to Remitly.

-

Both the services are quite fast in delivering money to the recipient and on time.

-

Even though Remitly has two options – Express and Economy, TransferWise has one single transfer option in its mobile app.

-

Once you add recipients in either of these apps, you can send the payments anytime you wish (especially to parents or siblings it’s very helpful)

-

Choose either one of these, both have almost similar services and there’s not much difference in terms of the amount received.

FAQs

Is TransferWise safe?

The setup process is very thorough and you are asked to provide detailed information confirming your identity (a picture ID) and also information confirming your address, like a utility bill. It appears very secure.

Is TransferWise legit and legal?

Transferwise is regulated in Canada and several other countries. The business checks and verifies every user to protect against fraud and money laundering.

How safe are my TransferWise login details?

Your login credentials are pretty safe. TransferWise has robust security and encryption in place to protect your personal information. There is also a two-factor authentication when logging in for the added extra security.

A very strong and unique password should still be used nonetheless.

How long does TransferWise take to transfer funds?

Well, It can take anything from a few minutes to a few business days for TransferWise to get money transferred to your recipient.

The actual length of transfer time depends on the currencies and the country you plan on sending money to. The other factors include how you’re paying when you pay, and if you need to verify who you are in the app or website.

Are there any restrictions on sending money to CAD?

According to TransferWise, you can’t send money to brokerages or intermediary banks.

However, you can make transfers to checking and savings accounts. And as a general rule, they don’t recommend sending For Further Credit (FFC) payments to bank accounts in Canada.

How long will TransferWise take to refund me if I cancel my payment?

Simply put, the time TransferWise takes for you to get your refund depends on how you paid in the first place and couple of other factors:

-

Direct debits and online bill payments take up to 1 working day and your money will have to be received first before it can be refunded back to you

-

Card payments take 2–10 working days

-

Wire transfers take 3 or more working days

Take note that, If you paid via online bill payment or wire transfer, additional information might be needed before you’ll receive a refund. An email will be sent if necessary.

You can see how long a transfer will take on the TransferWise website or by using the smartphone app.

In some cases, you can even see how long a transfer will take before paying for it.

TransferWise will send you a status update once you’ve made a transfer, notifying you where your money is at all times. You can also log into your TransferWise account to check the status of any transfer.

Payments with bank transfers can take slightly longer to clear, which may impede transactions. In most cases, it takes fewer than two business days for a refund to be processed.

Is the TransferWise smartphone app reliable?

The answer is “yes”, it is.

By using the TransferWise mobile app, It’s very easy to send money overseas in a fraction of a few minutes. The app is available on both Apple and Google play store.

The TransferWise mobile app also provides some extra features including:

-

Details of every beneficiary you’ve ever sent money to

-

Repeat previous transfers with a minimum of fuss

-

Fund transfers with Apple Pay and Android pay

What are the TransferWise transfer limits I should be aware of?

Below are the restrictions TransferWise limits in place:

-

Direct debit CAD transfers: $9,500 CAD per 24 hours and a 2-week maximum of $30,000

-

Credit card and debit cards: $3,000 CAD per transfer

-

Local wire transfer: $1.5 million CAD for each transfer

Is a TransferWise account required to receive money?

As a recipient, you do not need a TransferWise account to receive your transfer.

Once your name and bank details have been entered while preparing your transfer, TransferWise will make sure the money goes straight to your account.

Where Is the money stored?

Your TransferWise borderless account is not a regular bank account but an electronic money account. Your money is protected and secured.

Will TransferWise report money transfers to the tax authorities?

Well, TransferWise is still evaluating the impact of the Common Reporting Standards. This includes FATCA, to businesses and how the new requirements will be adopted.

At the moment, they do not report any information to HMRC or any other tax authority.

What happens to my money if TransferWise happens to go under?

TransferWise is authorized and regulated by the FCA, so this guarantees that they must operate segregated bank accounts.

It does so in accordance with Tier-One bank Barclays, so assuming TransferWise did go under, it is hoped that your deposits would be safe.

TransferWise Online Reviews And Comparisons

First of all, TransferWise is a top choice for transnational money transfers. They are known for their great customer service, have excellent reviews on Trustpilot.

Nearly nine in ten customers said that TransferWise was “Excellent” or “Great,” and they have an all-around score of 4.6 out of 5.

They also provide an impressive user experience, from an easy sign-up procedure to effective transfers.

The company employs around a thousand people from over 60 nationalities across its nine offices around the world.

Employees have given the company close to a 5-star rating on the employer review site Glassdoor.

In the review, TransferWise has been described as a “great company that is doing an awesome job” full of “smart and motivated people”. The reviews also mention that TransferWise is “super customer-focused” with an “excellent culture.” overall.

Generally, it is evident that employees love working there and that they feel that they are on a mission to make sending money as inexpensive and convenient as possible.

There are quite a few negative reviews as well.

The Negative reviews mentioned are all about the bank fees, delays in transfers.

Also the issues with getting verified, and account suspension (which to be fair are outside the control of TransferWise)

Conclusion

Well, that was my honest review of TransferWise. I really hope that you found the article useful. My personal recommendation is, please try TransferWise once, it can help you save some real money especially during international money transfers. I’ve personally used TransferWise and Remitly to send money to the US and India, both the services are equally good, fair and fast.

We all know how high transfer fees and exchange rates can be. Especially it’s toll when sending money internationally, whether as a freelancer or business owner.

And the cherry on the cake? You get to know upfront how much you’re being charged without running the risk of paying dubious hidden fees.

Therefore, I would recommend TransferWise as a very reliable and fast way of sending money all over the world.

Let me know your thoughts and comments below, do share this article on social media and help spread the word. Thanks for reading!

Top 10 Popular Posts Of All Time

- Top 30 Canadian Blue Chip Stocks You Should Own

- How To Use A My Service Canada Account

- How To Watch Free TV Shows In Canada – List of 10 Best Sites

- VGRO Review – Vanguard’s Best Growth ETF Portfolio

- Top 7 Canadian ETFs You Should Own

- Top 150+ Dividend Stocks In Canada – Complete List

- Credit Karma Canada Review – Free Credit Score And Report

- CPP Payment Dates – How Much CPP Will You Get?

- Top 5 High-Interest Savings Accounts In Canada

- How To Open A CRA My Account?