Wealthsimple Trade is a Canadian commission-free stock trading platform. It is the subsidiary of Wealthsimple – an auto-pilot investment firm. If you are new to Wealthsimple or don’t have much information about them – Wealthsimple is one of the best auto-pilot investment companies in Canada.

There are few other options you can consider with the likes of Mylo, BMO Smartfolio which are equally good if not better, depending on your needs. But, none of them offer the same premium user experience and clean interface as Wealthsimple does. Wealthsimple is really good! You got to give it a try to decide. It is Free to join and access all the benefits.

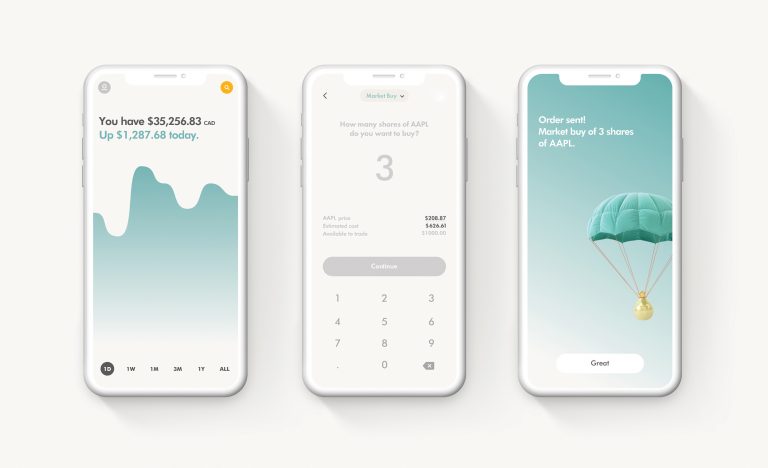

As I just said, Wealthsimple is completely FREE to join. You can pretty much sign-up to the platform and start investing in a matter of a few minutes. The best part is, you can do all of this from your smartphone. Wealthsimple’s iOS app is easy and intuitive to get started, checking your balance is easy with and one-tap, it’s secured with face id and two levels of encryption for enhanced security, portfolio options to invest in are extremely good and beneficial to one and all.

Overall, Wealthsimple is a one-stop solution if you are looking to invest your money through small incremental investments through spare change or to transfer your existing TFSAs and RRSPs and contribute weekly or monthly thereafter.

I’ve covered my complete and in-depth review of Wealthsimple here – Its up-to-date and do check it out here

Also, If you want to check out my complete and in-depth review on Mylo and BMO’s SmartFolio (Do click on the individual links to read the complete review). Alright then, in this article I’m going to talk exclusively about Wealthsimple Trade and will try to answer as many questions you may have when compared to Questrade. Let’s get started.

What Is Wealthsimple Trade?

Simply put, Wealthsimple Trade is a commission-free stock trading platform based out in Canada.

The Wealthsimple Trade App lets you buy and sell stocks and exchange-traded funds (ETFs) on the major Canadian and US stock exchanges. So you get the benefits of trading in both currency markets. All for FREE.

So What’s The Catch Here? Or Why Is Wealthsimple Trade FREE?

You might probably know, if not, In Canada, when you buy or sell a stock using any of the investment platforms – Be it a bank or Questrade for instance – you’ll pay a per-transaction fee anywhere between $5 – $30 to buy a stock and then similar amounts to sell.

Even if you consider the base minimum of $5 to buy and sell, for one complete transaction, you would’ve spent $10.

Similarly, every financial institution has its own buying and selling transaction costs involved.

Now what Wealthsimple trade does is, it offers stock buying and selling including ETF trading for FREE! But, wait for a second, How Does It do that?

Why Is The Wealthsimple Trade Free?

Wealthsimple Trade is Free for the following reasons –

1. First of all, Wealthsimple Trade is completely a mobile-only platform (the desktop version is not yet available, at this moment at least), it charges no commissions on trades, and has no minimum balance required – That means you can start trading with a bare minimum of $1 in your trading account.

2. Wealthsimple’s Trade platform uses advanced and latest mobile technologies to drastically reduce their operating costs by eliminating the things that make traditional brokerages expensive. For Example – they are cutting down on costs by eliminating the need for physical branches, and larger teams, and replacing old legacy systems

3. If you have ever used Wealthsimple’s app – The first thing you’ll notice is how easy and simple it is to use. Wealthsimple Trade follows the same benchmarks – It is simple to use, intuitive, paperless and more of a human system.

4. Opening a new account takes a few minutes and a couple of mobile taps. You don’t need to do any paperwork here. It’s all automated.

5. Last but not least, the Wealthsimple Trade platform is a division of the Canadian Share Owner Investments Inc. and is a registered investment dealer and also a member of the Investment Industry Regulatory Organization of Canada (IIROC). Rest assured, all of your hard earned money is safe here!

Wealthsimple Trade will charge you a $0 commission on all of your stocks and ETF purchases. They only make money on the currency exchange fees (or forex fees) for the US stock trades.

Wealthsimple Trade Fees

You can find the complete list of Wealthsimple Trade’s fees below:

1. Fee for the US & Canadian listed stocks and securities – FREE

2. Account Opening Fee – FREE

3. Account Closing Fee – FREE

4. Deposits via Bank Transfer – FREE

5. Withdrawals via Bank Transfer – FREE

6. Electronic Statements & Trade Confirmations – FREE

7. Inactive account fee – FREE

8. Foreign Exchange Fee (Canadian to US Dollars and vice versa) – Wealthsimple Corporate Rate 1.5% (most brokerages charge around 2%)

9. Outgoing account transfers to another institution – FREE

10. Returned Cheque or Non-Sufficient Funds (NSF) – $35

As you can clearly see, at Wealthsimple Trade you’ll only be charged the NSF fee of $35, other than that, every other service and transaction is FREE of cost for you!

How Does The Wealthsimple Trade Work?

In this section, let’s look at how the Wealthsimple Trade platform works and what are the benefits of switching over to them other than the benefits listed above.

Benefits Of Using the Wealthsimple Trade platform –

1. You’ll pay a $0 commission on any number of trades forever (buy or sell stocks/ETFs)

2. No account minimum balance means you can get started with as little as $1 here

3. Ease of getting started with no paperwork upfront or anytime

4. You will be able to search and track your favorite stocks easily with the watchlist feature

5. You’ll be able to buy and sell stocks or ETFs with just a few taps using the mobile app.

How To Open A WealthSimple Trade Account?

In this section let’s look at the eligibility factors to open a new account.

In order to open a new Wealthsimple Trade account, you must:

1. Be a Canadian citizen, Canadian permanent resident, or have a valid Canadian visa

2. You should be at least 18 years old, at the time of opening the account

3. Have a valid Social Insurance Number (SSN number)

4. You should have a valid Canadian residential address, which is required while signing up.

5. You must be able to satisfy Wealthsimple’s identity verification requirements by using a valid Drivers License or Passport.

How Safe Is WealthSimple Trade?

First of all your hard-earned money is pretty much safe with Wealthsimple Trade.

Moreover, Wealthsimple Trade is a division of the Canadian Share Owner Investments Inc and is a member of the Investment Industry Regulatory Organization of Canada (IIROC) and the Canadian Investor’s Protection Fund (CIPF) which protects your accounts up to $1,000,000 against the money held in the platform.

Also, as a matter of fact – Wealthsimple holds over $5 billion in client assets, so you’re certainly not alone in trusting them.

What Types Of Assets Can I Purchase Using the Wealthsimple Trade Platform?

Wealthsimple Trade currently supports the following asset types :

1. Stocks

2. ETFs

At this moment, Wealthsimple trade does not currently support the below assets:

1. Mutual Funds

2. Preferred Shares

3. Options

4. Securities that trade over Over-the-counter (OTC)

5. Forwards & Futures

6. Rights and Warrants

7. Bonds

8. Investment Savings Accounts & Money Markets

9. Stocks & ETFs that trade on non-North American exchanges

10. Cryptocurrencies

11. Securities that have a T+1 settlement period

So if you are looking to invest in Mutual Funds or Bonds right now, I’m afraid, you’ll not be able to do so. The platform does not support that yet. But the good thing is, you may get it anytime soon, so do keep an eye on that. Apart from that, regular trading and investments in Canadian and US Stocks, ETFs should not be a problem.

Can You Trade Options On Wealthsimple?

The short answer is “No’.

At this moment, Wealthsimple Trade does not support Options or Short Trading. However, it is very likely that this feature will be available soon. Again, I’m not sure when.

Wealthsimple Trade Desktop

Unfortunately, at this moment, Wealthsimple Trade is only available on your smartphones and not the desktop.

However, the desktop feature may roll out pretty soon.

With that said, Wealthsimple’s mobile trade platform is really easy and simple to get started. Signing up will hardly take a few minutes and all you need is a $1 minimum balance to start trading. Also, with the domination of smartphones in the market, desktop trading is slowly fading away, we all use our smartphones for browsing and performing bank transactions; more than we do it on desktop.

What Stock Exchanges Are Supported By Wealthsimple Trade?

Wealthsimple Trade currently supports Stocks and ETFs trading on the following four stock exchanges:

1. Toronto Stock Exchange (TSX)

2. TSX Venture Exchange (TSXV)

3. New York Stock Exchange (NYSE)

4. NASDAQ

The majority of the Blue Chip stocks, stocks in general and ETFs are listed on these four major stock exchanges across Canada and the US. So you should be good at trading in these exchanges.

Wealthsimple Trade Withdrawal

In this section, let’s talk about how you can withdraw your funds from the wealthsimple trade platform.

You can withdraw funds from your Wealthsimple Trade account by following the below steps –

1. First, click on the icon in the top left corner of your app’s screen to open the sidebar and select “Account” from the list.

You’ll then be able to submit a request for funds withdrawal from your settled and available funds and selecting a bank account for cash deposit.

2. You will only be able to withdraw settled cash in your account. Make sure you check this before placing the withdrawal request.

3. Last but not least, Once you submit the withdrawal request, you should receive the cash in your bank account within 2 to 3 business days.

Can You Invest In Your TFSA and RRSPs Using Wealthsimple Trade?

Of course yes!

If you don’t know yet, TFSAs and RRSPs are tax-free investment instruments supported by the Canadian Government. for the benefit of all

Every year there is a cap on the limit you can invest in your TFSA account – for the year 2019 the cap is $6000 for TFSA, similarly, with RRSP you can invest a maximum of 18% of your previous year’s net income.

The advantage you get by investing in the Wealthsimple Trade TFSA and RRSP account is – All your investments and trade will be tax-free growth. All of the gains you make by buying and selling the stocks will be tax-free and commission-free. I mean to say capital gains are tax-free. All the dividends you earn within the tax-sheltered TFSA and RRSP are also tax-free.

The only advantage you’ll get by investing in the RRSP account is when you invest in US stocks – In the case of TFSAs, dividends earned from US stocks be taxed as it not considered by the US Government to be a retirement instrument, whereas in case of the RRPS’s dividends received is totally tax-free.

Also, a quick note here, any unused tax contributions from the previous years can be carried forward to the new financial year and fresh investments can be made using the Wealthsimple Trade platform and the stock exchanges listed.

Wealthsimple Trade vs. Questrade

In this section let’s quickly compare and look at the key differences between Wealthsimple Trade and Questrade investment platforms.

We have already extensively looked at the Wealthsimple Trade platform so let us first start with Questrade and how it compare to the features of Wealthsimple Trade.

Questrade was established in the year 1999 and provides a trading platform to trade stocks, forex, options, bonds, ETFs, CFDs, and mutual funds.

Moreover, it also offers GICs, international equities, access to public IPOs, and precious metal purchases.

Questrade has two great ways for you to invest with lower fees:

1. You can buy and sell your own investments (also called DIY Investing)

2. Or you can invest in a pre-built Questrade portfolio

Pros Of Questrade vs. Wealthsimple Trade

1. Questrade had been around for many years now – It is a developed and mature trading platform

2. You can do the Options Trading

3. You’ll have access to more markets and securities (Wealthsimple trade offers only 4 major stock exchanges)

4. Overall better access and interface – Wealthsimple Trade is phone only, whereas Questrade is phone and desktop

5. Awesome customer service when you need it – Questrade’s customer service is too good when you need them

6. If you are buying and selling stocks in the short term go for Questrade, as they don’t have a 15-minute market delay and also have news attached to each stock in your watchlist

Cons Of Questrade vs. Wealthsimple Trade

Let’s now look at a couple of cons of Questrade against Wealthsimple.

1. Questrade is pricey – Questrade has buying and selling fees for stocks, and just a selling fee for ETFs, plus a conversion to USD fee (exchange fees)

2. Questrade takes an inactivity fee if your account balance is below $5000 in equity stocks

3. Except for the purchase of ETFs, none of the other equities are free to trade here – whether buying or selling. Whereas Wealthsimple Trade is completely free to buy and sell

4. You need a minimum of $1000 in your account to start trading in Questrade. Whereas in Wealthsimple Trade it is just a $1 minimum account size

Final Words

In a nutshell, Wealthsimple Trade offers a free trading platform that is mobile-only at the moment. You can definitely expect the desktop version in the future.

The platform currently supports trading across the major stock markets in Canada and the US. Wealthsimple is already well established and has excellent reviews and feedback from Canadians.

Apart from the $0 fee, Wealthsimple trade currently only supports trading of stocks and ETFs, there is no options trading or you cannot buy mutual funds at this moment. But, you can expect all these features to be available in the near future.

In comparison, Questrade is one of the best trading platforms, known to Canadians and is trusted by millions already. It is available on both desktop and mobile versions. I have listed both the pros and cons of using this platform. Also, the phone support at Questrade is excellent, if that’s what you are looking for.

If you find the content of this article useful or helpful to someone out there, please do share it on social media. Help spread the content. Also, do let me know your thoughts and comments in the comment section below.